Empowering Solar: Exploring Financing Choices

Going solar is a powerful move towards sustainable living, but the initial costs can be a concern. Luckily, various solar financing options exist to make this eco-friendly transition accessible and affordable for homeowners.

Understanding the Investment: Long-Term Savings

Before delving into financing, it’s crucial to recognize solar as an investment rather than an expense. While the upfront costs may seem significant, consider the long-term savings. Solar panels can significantly reduce or even eliminate your electricity bills, providing a return on investment over time.

Cash Purchase: Upfront Investment for Long-Term Gains

For those with the financial means, a cash purchase is the most straightforward solar financing option. By paying upfront, homeowners immediately own the solar system and enjoy the full financial benefits. Although it requires a substantial initial investment, the long-term savings and environmental impact make it a compelling choice.

Solar Loans: Bridging Affordability Gaps

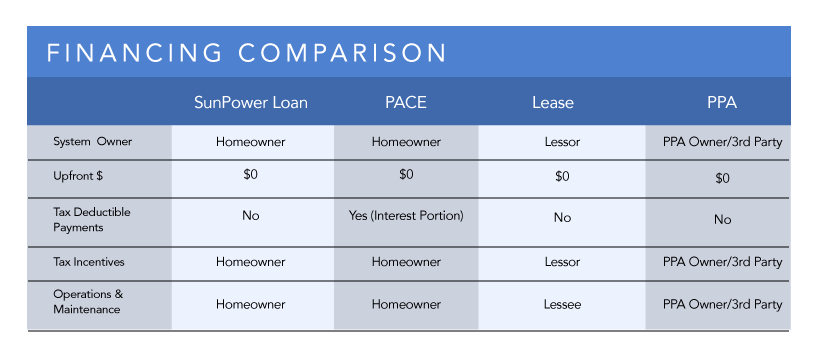

Solar loans are designed to bridge the affordability gap, allowing homeowners to install solar panels with minimal upfront costs. These loans come with various terms and interest rates, providing flexibility for different budgets. Homeowners can enjoy the benefits of solar energy while paying off the loan through manageable monthly installments.

Solar Leases: No Upfront Costs, Regular Payments

Solar leases offer a different approach, allowing homeowners to “rent” solar panels without any upfront costs. In this arrangement, a third-party company installs and maintains the solar system, and homeowners pay a fixed monthly lease payment. While this eliminates upfront expenses, the financial benefits may be shared with the leasing company.

Power Purchase Agreements (PPAs): Pay for Solar Power Produced

Power Purchase Agreements (PPAs) provide homeowners with a unique financing model. In a PPA, a third-party owns and operates the solar system installed on your property. Homeowners pay for the solar power produced at a predetermined rate, often lower than traditional utility costs. PPAs are an attractive option for those looking to save without owning the solar panels.

Government Incentives and Rebates: Lowering the Cost Burden

Many governments offer incentives and rebates to encourage solar adoption. These can significantly lower the overall cost of installation. Research the available programs in your area, as these financial incentives can make solar financing more attractive and reduce the payback period for your solar investment.

Home Equity Loans: Tapping into Home Value

For homeowners with substantial home equity, a home equity loan is a viable solar financing option. By leveraging the value of your home, you can secure a loan with favorable terms. This option allows you to invest in solar without compromising your savings, spreading the cost over a more extended period.

PACE Financing: Property Tax-Based Financing

Property Assessed Clean Energy (PACE) financing is a unique option where the cost of solar installation is repaid through property tax assessments. PACE programs are designed to make solar financing accessible, and the repayment is tied to the property rather than the individual. This option is worth exploring for those looking for alternative financing structures.

Combining Options: Tailoring to Your Budget

In many cases, homeowners choose to combine financing options to tailor a solution that suits their budget and financial goals. For example, combining a cash payment with government incentives or a solar loan can provide the best of both worlds—upfront ownership with reduced costs.

Empower your journey towards sustainable living by exploring diverse solar financing options. Each option brings its unique advantages, allowing you to choose a financing model that aligns with your financial objectives and contributes to a greener future.